Making a major purchase is always a difficult decision, especially if you are retired and on a fixed income. I like to make my decisions based on cost-per-use, a rule-of-thumb that I apply to almost every investment that I make. For me, it’s all about breaking down the math! I try to live on a budget, hoping to stretch my remaining dollars over the next twenty years or so. I would prefer to spend all these dollars on travel but that’s just not possible. This morning, for example, I had to call for a plumber…bummer, and it was time to put some of those math skills to work.

Travel dollars are more about cost-per-memory, an intangible value beyond mathematics. However, necessities, like replacing my water heater might cost $1250, a sum that I would definitely rather invest in an airline ticket. On the other hand, I could gamble on a temporary pilot-light repair for $350, but it might be a problem again next year or next month. A travel adventure could be anywhere from a weekend to a month in length, so the longer your stay, the lower your cost-per-day-away of an airline ticket. Days-of-use are the key in any case. A water heater is something you use every day, so an extended year breaks down to less than $1 a day, while the daily-cost-per-use of a new water heater would be $3.42. If that new water heater lasts ten years, the cost-per-day is only 34 cents. Also, if you consider how many times a day you use hot water for showers, dish-washing, laundry, and hands, the cost-per-use is just pennies. Somehow that makes me feel better, but not as good as a trip somewhere.

Let’s consider some of the bigger investments you make in life over a span of ten years. $30,000 cash for a new car is $8.21 cents per day whether you use it or not. If you use it three times a day, that’s only $2.73 cost-per-use. If your marriage lasts for 25 years, a $25,000 wedding ring is less than the cost-per-use of a car. Of course, love is priceless! If you live in a $200,000 home for 30 years, you probably pay nearly twice that cost in interest, but it’s still less than $36.50 a day. Pay cash and it’s only $18 dollars a day or 75 cents an hour – much better than any Motel 6, but “leave your lights on” at home and that cost goes up.

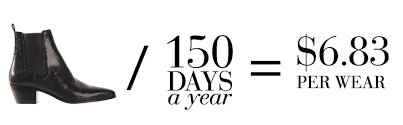

My wife recently bought a pricey stroller for our gimpy 100-year old dog. She announced yesterday that after five uses the cost-per-use was now down to $60. Our grill on the back deck is easily down to less than $10 a use, with years of life left on it. I gave it a good steam cleaning the other day, so it will someday approach free! One really bad investment we made was in a women’s bicycle that is still probably well over $250/use over 6 years. It’s also been moved from house-to-house and state-to-state in the process. Exercise equipment often falls in this high-cost-per-use category, while the cost of jewelry can easily be justified if it gets daily wear.

If something is going to get limited use, it’s obviously better to rent than buy. I’ve certainly gotten a lot of use of this computer that I write on every day. After 633 posts, the cost-per-post on this blog is now down to under $3. It gets other use as well, probably five hours a day when I’m not traveling. It gets used for movies on airplanes, but gets limited use in hotel rooms, as most of my writing tends to be done on my smart phone. If I stick with my 80/20 travel rule (See Post #323), it boils down to about 128 hours monthly on the computer over 20 months of retirement, bringing my cost-per-use down to about 75 cents an hour. In a couple more years, it will be free and I will be older.

Leave a Reply